Week ending 11th April 2025.

4/11/2025

This volatile week has underscored the value of maintaining a long-term focus. Markets endured a dramatic sequence of events—plunging early in the week as trade tensions flared, only to soar midweek after a surprise policy pivot from the White House. This highlights the importance of staying focused on long-term investment objectives rather than reacting to short-term market noise.

Trump’s so-called reciprocal tariffs came into effect earlier this week, causing a broad sell-off in global markets. Then came Wednesday, and with it, Donald Trump’s dramatic reversal, dropping tariffs to a blanket 10% for 90 days to allow for trade negotiations with most of the countries and territories targeted. Critically, China was not included in the pause, but even a partial reprieve was enough to ignite a powerful rally. That single day transformed the week. The S&P 500 jumped 9.5%, marking its ninth-largest daily percentage gain in history, while the Nasdaq Composite surged over 12%, recording its second-best session ever.

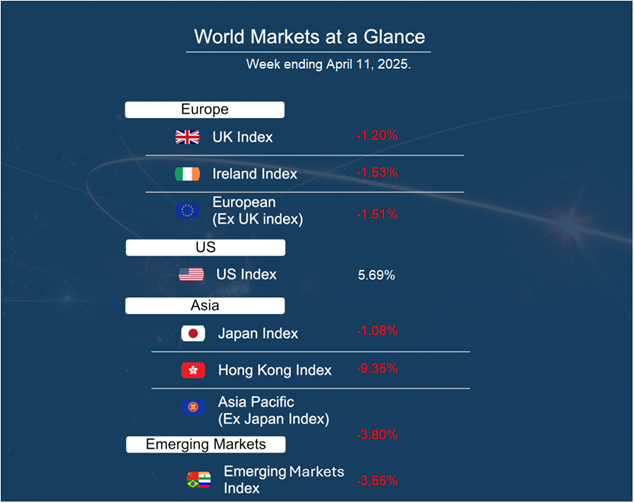

By Friday, the S&P 500 had gained 5.7%, the Nasdaq was up 7.3%, and the Dow Jones rose 5%, rounding out one of the most dramatic weekly turnarounds since the financial crisis.

Markets in Europe and Asia staged significant recoveries following the U.S. pause announcement but ultimately closed the week lower as the tit-for-tat tariffs between the U.S. and China continued. President Trump pressed ahead with aggressive tariff hikes on Chinese imports, raising duties to 145% by week’s end, while Beijing retaliated with 125% levies on U.S. goods, describing Donald Trump’s brinkmanship as “a joke.”

We have consistently advised investors to avoid reacting impulsively to sharp market pullbacks, and this week provided a clear illustration of why. Despite the unsettling headlines, patient investors were rewarded as the markets swiftly rebounded reaffirming our belief that Trump’s trade tactics are merely short-term noise.

Economic data wise, U.S. inflation cooled more than expected in March, with headline CPI dropping to 2.4% from 2.8%, and core inflation easing as well — supporting the view that price pressures are cooling. While full impact of the proposed tariffs may not yet be visible, the data, along with a strong labour market and resilient spending, suggests the U.S. economy remains solid.

In the UK, the FTSE 100 rose on Friday after the economy unexpectedly grew 0.5% in February, driven by strong services and a surge in exports to the U.S. ahead of new tariffs. While the data lifted markets, expectations for faster rate cuts from the Bank of England persist, with analysts cautioning that growth may falter amid trade and geopolitical pressures.

Just when investors thought the week had delivered its final twist, the White House dropped another surprise—this time after markets had closed on Friday. On Saturday, the Trump administration announced that it would exempt smartphones, computers, semiconductors, and other key electronics from the newly imposed China tariffs. The exemption, backdated to April 5, is expected to ease pressure on the tech sector and help prevent a sharp rise in consumer device prices.