Global Index Service

A managed investment portfolio

Invest in a diversified investment portfolio managed by our Investment Management Team on a discretionary basis. You can choose to invest in a stocks and shares ISA or general investment account (GIA).

Your capital is at risk when you invest. Tax treatment depends on individual circumstances and may change in future.

Start investing today with a minimum lump sum of £1,000 and make regular contributions from as little as £50.

Personal Guidance

Before you invest, you will speak to a Personal Financial Coach who can guide you through important investment considerations to help you make an informed decision. They will also assist you in assessing your appetite for risk to ensure the service is a right fit for you – before any investment is made.

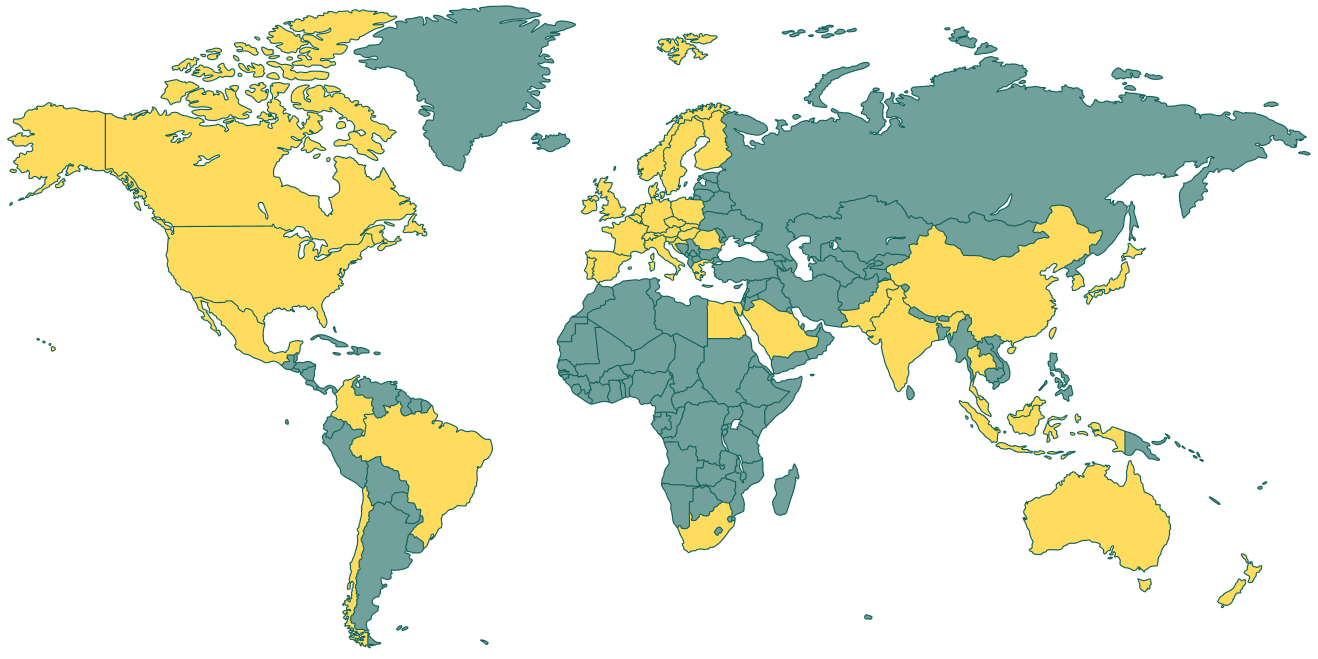

The Global Index

The Global Index is a ready-made portfolio containing a selection of exchange traded funds (ETFs). An ETF is an investment fund that aims to replicate an index from the stock market – meaning it is a ‘bundle’ of different shares from a variety of companies, sectors and geographic locations. The main advantage of investing with ETFs is it is low cost and is a simple way to ensure your portfolio is diversified.

Our Investment Management Team have chosen a range of ETFs which provide exposure to a selection of different markets across the globe.

Discretionary portfolio management

The portfolio is managed by the team on a discretionary basis – meaning our Fund Managers can buy and sell funds within the portfolio at their discretion. This is to ensure it remains in line with the portfolio aims.

Speak to us about our Global Index Service

Our Wealth Services team are happy to help answer any of your questions. Our lines are open 9am to 6pm Monday to Thursday, and 9am to 5pm Friday. We are closed at the weekend. We will respond to all emails within 24 hours or the next working day.

No advice is offered in the provision of the stocks and shares ISA or general investment account provided by my wealth invest. Tax treatment will depend on your individual circumstances and is subject to change in future. The value of your investments may go down as well as up, and you could get back less than your initial investment. ISA rules and terms & conditions apply.

my wealth invest provides non-advised investment services and is part of the Wealth at Work group. The investment options offered have been specifically created for those with simpler investment requirements.

my wealth invest is a trading name of Wealth at Work Limited which is authorised and regulated by the Financial Conduct Authority and is part of the Wealth at Work group. Registered in England and Wales No. 05225819. Registered Office: Third Floor, 5 St Paul’s Square, Liverpool, L3 9SJ. Telephone calls may be recorded and monitored for training and record-keeping purposes.